Week 50 Liverocket Performance - Down 2.19%

The TRID experience hurt (almost 100% of our loss this week). The tight stops I set also mean that we have a significant cash position: almost $103K or 77% of the total value.

I expect the market to soften and for us to be in cash 100%. If there are sever market crashes, I will look to re-enter several of our positions:

TRID

UCTT

ILMN

OCN

Among others.

With earnings season ending, I am going to do a robust analysis of stocks to find some additional gems.

My trading approach is to assume that the market will retreat. A lot of people talk about a year-end rally, but I am holding back for these reasons:

1. Pullback after earnings season

2. Run-up since August without any pullback

3. Election nervousness - gridlock is possible and the markets won't like it

4. The usual various panic moments (interest rate fears, inflation fears, rising oil prices, and so on)

5. Strange disconnect between disappointing economic data (GDP, employment, inflation) and market reactions

So I'll buy on panic moments.

My investment approach is that there are some gems worth buying, regardless of overall market conditions. However, I believe that we are in that period of lag between real falling economic conditions and when the data appears. I noticed that an awful lot of companies reported earnings that beat but did not smash expectations.

More critically retailers are nervous. Whole Foods is expecting a slower 2007. Walmart is launching a price war. Retailers are responding to a slowdown. I was clearly and furniture makers - not because I was wrong (I was dead right that they are crashing) - but because the market won't let the stocks die. It's only a matter of time tho.

Where will I focus?

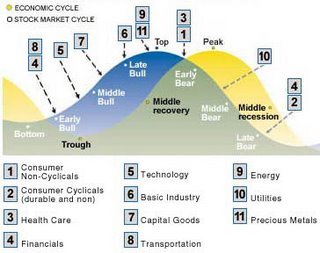

1. Avoid contrarian moves. Market is following the traditional belief that a slowdown is coming, so avoid the usual suspects: manufacturing, raw goods, consumer durables and so on. This includes oil and autos.

2. Housing is the plague. Avoid it at all costs. Avoid financial companies unless tied to M&A. Avoid construction and anything home related

3. Anything airplane related is hot. Same with entertainment.

4. Healthcare will enjoy some focus as a defensive move (we have ILMN)

I'll have more in a week or so.