Market crashing? Stopped out of KSU, TRID, UCTT

I have spoken previously about my concern that the market momentum is disconnected from the underlying fundamentals. Put simply: why is the market going up when the economy is starting to show signs of a slowdown?

How do we know the Economy is slowing?

1. GDP was averaging 3%+ and is now at 1.6%

2. Consumer spending is falling

3. Manufacturing is falling (except planes)

4. Housing construction is falling

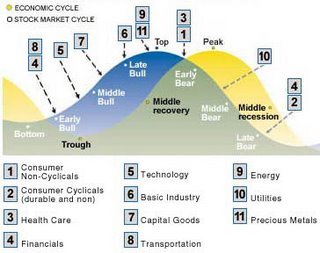

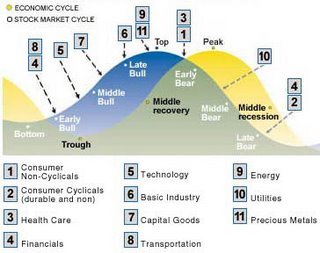

Go back to the concept of the business cycle. A specific indicator of the end of the business boom is that wage pressure grows as GDP trends down.

Go back to the concept of the business cycle. A specific indicator of the end of the business boom is that wage pressure grows as GDP trends down.

But the market reached a new peak. I think that the market is overshooting and we need to be prepared.

In many ways, we could follow the path dictated by the economic cycle: focus on utilities, healthcare and consumer non-cyclicals(dividends) and exit all capital goods, metals, industry, technology & so forth. I put us in ILMN and AET for healthcare, TRID for non-cyclicals, and OCN as counter-cyclical (it should rise as mortgages foreclose). I also put us in T because in many ways I see them as a utility (without a dividend).

I also continue to choose the path of focusing on companies with unique positions. UCTT for example.

I have invested heavily in oil equipment and services and they are taking a beating. The market believes that we are at the tail end of a boom and that any US downturn will turn into an oil oversupply. Or more simply - Goldmann Sachs got out of oil so other funds did as well. I am waiting to late November to decide what to do. I expect the price of oil to change according to weather conditions here, and so far they are mild.

How do we know the Economy is slowing?

1. GDP was averaging 3%+ and is now at 1.6%

2. Consumer spending is falling

3. Manufacturing is falling (except planes)

4. Housing construction is falling

Go back to the concept of the business cycle. A specific indicator of the end of the business boom is that wage pressure grows as GDP trends down.

Go back to the concept of the business cycle. A specific indicator of the end of the business boom is that wage pressure grows as GDP trends down.But the market reached a new peak. I think that the market is overshooting and we need to be prepared.

In many ways, we could follow the path dictated by the economic cycle: focus on utilities, healthcare and consumer non-cyclicals(dividends) and exit all capital goods, metals, industry, technology & so forth. I put us in ILMN and AET for healthcare, TRID for non-cyclicals, and OCN as counter-cyclical (it should rise as mortgages foreclose). I also put us in T because in many ways I see them as a utility (without a dividend).

I also continue to choose the path of focusing on companies with unique positions. UCTT for example.

I have invested heavily in oil equipment and services and they are taking a beating. The market believes that we are at the tail end of a boom and that any US downturn will turn into an oil oversupply. Or more simply - Goldmann Sachs got out of oil so other funds did as well. I am waiting to late November to decide what to do. I expect the price of oil to change according to weather conditions here, and so far they are mild.

2 Comments:

Near as I can tell, LR stopped out of

ILMN, KSU, OCN, TRID, and UCTT.

Over the past 3 days, each of those

stocks traded below their LR STOP

point.

Do you see LR getting back into any

the above positions?

we got stopped out of ocn as well.

Post a Comment

Subscribe to Post Comments [Atom]

<< Home