This was posted by someone who reads this blog

You are in love with this company. When the options scandal occurred you said no material expense and held on. When they expensed it, you said the matter has been cleared up and now it can rise. You also thought the CEO was just greedy, not unethical. Well he was kicked out, so I dont think you were correct there. I think you need to be concerned that maybe their numbers are also not so ethical and those numbers that are giving you $ eyes may be a mirage.I think several resignations/firings means things are not at all right with this company. Dont lose your shirt. This person is absolutely correct. For almost 9 months I have been in love with TRID and I have lost a lot of money.

I have not ignored the negatives, I simply felt that the positives were too strong.

I am, first and foremost, a follower of fundamentals. Time and time again, I have seen companies surge or collapse because of the underlying health of their business. Sure, there is always room for other variables, but ultimately a stock grows because the company's business is growing.

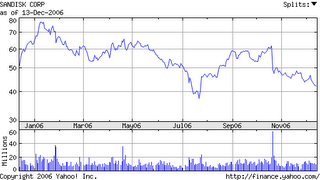

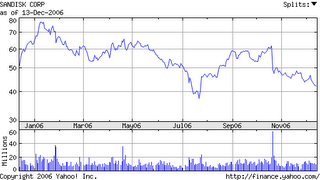

The model that I have crafted does factor in the other variables. For example, I love Sandisk, but there is no denying that the stock is broken stock. The market sentiment is not with them

Fundamentally, I know that TRID's business isn't just growing, it's surging. But the market sentiment is not there. Very rarely do I make contrarian plays. I can be absolutely correct about a company's prospects and the market was wrong but catches up to me (NTRI, BMHC, CPWR). I can also be 100% correct and the market doesn't care about the rising or crashing fundamentals (WHR, ETH, RSH, NVL, WFMI, for example). That is why I rarely go contrarian: I can be 100% dead-on correct about a company's health but the market takes a while to be rational.

What to do about TRID? If the market were positive about the company, this would be a $50 stock, no question (40 P/E minimum given 90% earnings growth). If the market were neutral, this would be a $30 stock. They lack market support but that doesn't last forever. Solid numbers have a way of waking up Wall Street.

I also note that they tested their $19 low and have re-bounded. Not a strong re-bound, but a re-bound anyway.

It is only a matter of time. Today, Wall Street sees a company that offers unclear earnings history and unclear Executive management. Questions remain. This is exactly why I have been loading up on them: uncertainty will disappear soon and the fundamentals will shine. A new leader will be brought in. The PR spinning and positioning will start up again.

I am waiting and thinking of even buying more to average up.