Stock review

I am incredibly disappointed by semiconductor stock valuations. Because sales are way up. SEMI just announced that silicon wafer shipments are up 18% in 2006. Ah well, I blame sector rotation.

Meanwhile, housing stocks continue to stay up despite obvious signs of impending collapse.

A very volatile week for oil equipment & services stocks. Up then down and then up.

The issue is oil prices and the perception that cheaper oil will not drive up demand for drilling. The questions are basic:

Are we in a longer term oil shortage or does the US slowdown reduce oil demand? The US has enormous impact on oil – we use 25 barrels per person versus 1 barrel for India and China. But India and China have 4x the population. And they are surging in demand for oil. The CEOs of oil companies know that any slight October surplus in oil is limited to October and that intermediate and long term demand is outstripping supply.

Are near term drilling contracts affected by oil prices? Most certainly, but only from a bargaining standpoint. Not every rig is the same: many rigs are old and getting ready for decommissioning, and many rigs can not handle the next generation offshore requirements for deep drilling. And much oil drilling is being undertaken by countries like Vietnam and by companies looking to acquire access to oil.

Is there anything else worth considering? Yes, rigs are locked up in multi-year contracts. Oil company CEOs make 10 year plans and they know the truth – they need these rigs. Also, geopolitics plays a role. Russia made a deal with BP to extract oil in the Sakhalin Islands off Japan. Russia no longer likes the terms and so they are slowing the development. So demand for 3 or 4 rigs disappears for a few months.

If the market is short these stocks, what should I do? First of all, I think anyone who is a market cycle trader has already left these stocks. That is, the commodity players bailed out already. They believe that the US economic cycle is ending and that the US cycle drives global oil demand. It does, but to a less and less degree these days. I would consider that oil prices will make these stocks fluctuate and it’s worth trying to accumulate on weakness. Every year oil prices sag in October (last year being the exception due to Katrina impact on the Gulf of Mexico as well as Iran and Nigeria concerns). This is no different.

Will Saudi Arabia cut production to boost Oil prices? What if they don’t. What if Bush is calling them and pressuring them. “It’s an important election time. Also, we can use a lower oil price to pressure Iran. And of course, if Iran wants to be silly and threaten to rollback their production, we would prefer the price to move up from the $55 dollar range and not $65. Then I could tell folks we can handle an Iran sanction.”

All of these are short term issues, and meanwhile the winter is closing in. Global demand for oil didn’t shrink just because fund managers overbought or oversold. Barclays is expecting a price of $80 per barrel next year, and at $60, I wouldn’t be surprised if China isn’t buying up futures.

I would buy LEAPs on oil equipment & service companies because any excess supply is purely short term.

One thing is clear: these stocks are under pressure and, until investors get clarity on oil price direction and demand, they are assuming the worst case. Prices will not move up dramatically until or unless commodity players see an energy boom.

------------------------------------------------------------

AET: Ended up for the week (+~3%). It was even higher mid-week. Our AET play is simple: take advantage of panic selling tied to last quarter’s earnings when they dropped from the 40s to the 30s. I think they could move up to the 50s over the next year, so we’ll sit on them for now.

AMX: Up ~3% for the week. It is almost at its 52 week high. The heady days of cell phone growth are over, but this company still has some strong growth. They are Latin America’s biggest cell phone company and most of these countries rely on cell phones and not fixed lines. I don’t know if AMX can offer the same robust types of services as their North American cousins, but this company’s stock price nicely balances the strong upside with a reasonable P/E. A 20 P/E with expectations of 150% earnings growth this quarter on 23% sales growth. That is amazing margin strength. Even the low estimate is 100% growth.

BMHC – What the hell is keeping this stock up? Seriously. BMHC has no positive news, only negative. We own Dec $25 puts, which gives us 2 quarters of earnings to capitalize on. So we can be patient – the stock is at $25.

Remember that I speculated a month or two ago that the next phase in the bursting housing bubble would be tied to slackening demand for raw materials. The result of an inventory build-up would benefit homebuilders as they squeeze for better prices while vendors would be hurt. Well, lumber prices have started to collapse and BMHC is a major lumber provider for framing and so forth. Prices have dropped from $380 to $200 in just 1 year, and most of that drop happened in the last 4 months. Ouch. For BMHC, the value of their inventory has just dropped, reducing their asset value (inventory is counted as an asset).

In other words – this company is a dog. But the price stays high because of speculation that Home Depot might buy them. Would HD try and vertically integrate? Maybe, but that would be a dumb move. Consolidation is a smart move when it achieves more market share (like the Maxtor purchase by Seagate), when it adds complimentary product lines (Cisco & Scientific Atlanta), or when it can reduce costs and boost efficiencies. Or to vertically integrate to achieve more price control and customer reach. That is what the BMHC/HD merger idea would be. But buying a company with collapsing earnings in a market sector that is itself collapsing just makes no sense to me. Better to do that when the bottom is closer – in 2 years or so.

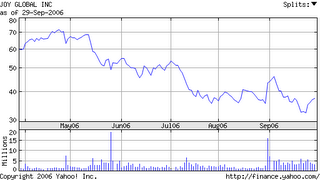

DO – Down 10% for the week (down even more at one point). To take advantage of short term weakness, we are setting a STOP of $65 and then going to buy back in.

EMT – We are selling Monday

ESV – Affected almost like DO. Down 5%. We were stopped out at $41.4

ETH – Furniture makers are showing weakness. Hooker Furniture reported a 20% drop in earnings (after you net last year’s and this year’s one time charges). A few weeks after saying that they were on target, ETH revised sales down 15%. That’s bad. I think the stock is up because of a recent investor meeting where calm words were given. Watch for disappointment over the next few months.

GLBL – Another weakened oil drilling stock. We were stopped out at $14.8

GRP – We were stopped out at $36. GRP hit a 52 week low. They are afflicted by Natural gas prices and possible drilling slowdown. Same as oil – perception versus reality. GRP recently reported an increase in their backlog (it is currently about 14 months).

ILMN – Up 3%. ILMN had two interesting pieces of news. The bad news was a downgrade to neutral. The analyst said insight into the ultimate size of the genotyping market was elusive and that projecting the long-term opportunities for genotyping products was difficult. Meanwhile, Duke University chose ILMN products for its autism study.

ISIL – I own this. After some very big semiconductor buyouts, I expected some interest in ISIL. Merrill Lynch seemed to think so too and they included ISIL on their Top 10 Buyout list. I just like buying 50% growth at a discount.

JNPR – Unbelievable that they are up. It has bounced back almost 50% from its summer low ($12 – a price I wished I’d closed our puts at). The issue as echoed in THESTREET.COM is that they are losing business to Cisco and they have an options problem. Earnings and Sales are flat to down but they have a 30 P/E. Sorry – they don’t deserve it. And their margins are collapsing. The shorts have increased 5%.

KSU - A nice 3% rise this week.

NUAN – What a ride – down and up 20%+. We are now back at our buy-in price. Up 4% on Friday alone and on massive volume. This is not just pre-earnings excitement. I think some good news has been leaked. Giddyap?

OCN – No movement. OCN used to be a sub-prime lender but they shifted to a debt collections service. I am going to quote someone from the industry.

“Ocwen is a servicing only mortgage company that doesn’t lend money and technically doesn’t even buy extant Mortgage Notes. Every mortgage has a clause in it allowing the lender to sell the mortgage entirely, or the servicing of the mortgage specifically. Ocwen only ‘buys’ the servicing rights to these mortgages. They traditionally only buy sub-prime paper meaning higher risk clients are who they are dealing with. This doesn’t necessarily mean people with poor credit. There are many reasons why someone would have to go sub-prime but none the less, the reason that brought them ultimately to Ocwen means they are a higher risk than ‘A’ paper lenders were willing to take. The most simplistic explanation of banking is the theory of ‘risk and reward’. The bank’s position is: ‘the higher the risk I’m taking by loaning you this money, the higher the reward I will net out as a result’. ’A’ paper lenders only lend to the cream of the crop – their investments are as safe as can be hence the reward (interest rate, terms) are skewed in favor of the borrower. Those who don’t fit the banks portrait of an ‘A’ borrower are relegated to the sub-prime industry. The sub-prime industry is taking a bigger risk and the client pays for that via higher rate and less attractive terms.”

Collecting loans is costly. Lots of departments and lawyers and so on. So banks make a deal with OCW. Banks hold title to the loan (they keep the debt). OCW buys the servicing rights and profits. Not only doe sthe bank outsource the collections part to OCW, OCW outsources much of the work to India. In this way, OCW’s exposure to loans is limited. They get transactional payments and any defaults are stuck with the loan agency. With the rise of foreclosures and defaulting loans, banks turn to OCW’s services. OCW gets to charge late fees and so on.

This is a sad part of the lending game and it is fairly unregulated. That is, collection agencies can set their own fees and charges. OCW has the best reputation of all similar agencies, but they are frequently subjected to lawsuits (people don’t like collection agencies).

RSH – This is incredibly frustrating. RSH has no future. There is a hoped for prospect that they may get bought out after the new CEO finishes housecleaning and cost cutting. RSH has a brand name with some value, but not much. RSH is up 30% since we bought puts. Yikes. A rival store – Tweeter – announced a 13% drop in same store sales and the stock dropped 27%.

STX – This one is bound to break out of its trading range. Meanwhile, it got hit by MRVL’s negative release. The danger for STX is that inventory could pile-up as PC & iPod sales slow. PC’s are 75% of the Hard disc drive business, so if they slow or fall, that has major implications. And the 2007 forecast is exactly that: slowdown city. So why am I in STX? First, because of servers and networking equipment. Digital entertainment is driving massive storage demand. Youtube movies sit on servers with hard drives. iTunes require servers. It is noteworthy that EMC raised sales guidance – again, more hard drives. Then there is the DVR growth. Data storage demand is mushrooming.

T – A pull back from a 52 week high of $33. We also got a $0.333 dividend ($106).

TIE – Waiting to break out of a trading range. Abandoned by hedge funds, TIE has been barely at $25. The response to earnings will tell all.

TRID – Never leaves me bored. The were notified by NASDAQ that they are delinquent in filings. Don’t be alarmed – so is JNPR, AAPL, and a few hundred others. TRID has clearly recovered and is on track. We have both the stock and Jan $22.5 calls.

TTI – Another volatile oil related stock. It moved 15% last week – down to $20 and then back up.

UCTT – A 4% pullback from the recent $11 52 week high. I was recently asked what UCTT does. Semiconductors are built layer by layer from metal deposited in gas form. Depositing this gas vapor requires incredible precision and is the single most critical part of the manufacturing process. Companies like Applied materials buy these systems from UCTT and incorporate them. UCTT has diversified into some other subsystems as well (liquid deposition). Most (89%) of its sales comes from AMAT, LAM, and Novellus. Technically, this stock is a winner. Business is booming (earnings up ~500% last quarter) but they have a forward P/E of 9.

WHR – WHR has pulled back a bit as reality is sinking in that demand is slowing for washers and dryers. Citigroup calls theam a SELL. Citigroup pointed to a drop-off in new washer/dryers (from new homeowners) and a renewed focus to replacement sales (upgrades). Citi thinks that the slowing housing value will slow that side of the business as well. WHR’s approach is to focus on boosting earnings. So they are moving 1,200 jobs to Mexico. However, these gains won’t show up for some time.

The consumer durables reports are strong enough to keep WHR afloat, but reality of this quarter should knock 10% of the shares, and next quarter another 10%.

ZOLT – Ughh. Down another 4%. And yet business is booming. ZOLT products are now used in Corvettes. Additionally, Boeing is using the material as a new bomb casing, replacing metal which tends to send out shrapnel. Anyway, this is speculative and so we wait.

ZRAN – Down 4%. I am waiting for earnings.

OTHER STOCKS I FOLLOW

CCJ – This is a uranium pure play. Uranium prices have been bursting and not slowing down (unlike gold, for example). Most of the uranium interest comes from Asia (especially Japan and South Korea). These countries want to avoid costly oil and have fewer environmental regulations. Uranium prices have tripled in the past 4 years and are still going up. I have sat on the sidelines because I believed that uranium prices would moderate. I was wrong and CCJ’s earnings grew 358% last quarter. Meanwhile, the stock has stayed in a trading range of $35~$40 for 6 months. The P/E is 33 and that is not necessarily high, but any slip in uranium price is problematic.

DIS – I own this. I think Disney is a powerhouse. It is the first major network to really jump on the iTunes bandwagon (ABC). I need to confirm statistics, but my gut tells me that wars tend to create more babies. And I see a lot more focus on babies since we went into Iraq. That spells more Disney customers. That plus the next Disneyland in Asia. Then there are the movies – Pirates was much more successful than folks imagined. I see DIS adding 15% per year in price appreciation.

ET – Haven’t owned ET in a while because of stock market weakness. I’ll buy on major weakness (say, $21) or when China operations are up.

PWR – I own this. Simply put, they lay cable. With Verizon and AT&T launching fiber to the home, PWR is the company actually doing the work. Oh, and they also do electrical lines as well.

RFMD – I own this. We had them in the LR portfolio for a while but got stopped out. I think cell phone prospects are strong – but not as strong as I once thought. The cell phone companies have not rolled out enough services to drive phone demand. For that reason I did not re-enter for LR. However, RFMD has grown sales and advanced from 9th to 7th largest seller of cell phone semiconductors. http://home.businesswire.com/portal/site/google/index.jsp?ndmViewId=news_view&newsId=20061004005179&newsLang=en

WSO – I own this. They are the leader amongst HVAC (heating and air conditioning) service and parts suppliers. The heat wave this summer could only have helped them. With more and more houses being built and more and more buildings being built, that’s more customers needing support.

GHL – I have been on the sidelines waiting for the insiders to dump their shares. I am still waiting. I bet they do it when the stock hits $70

PCP – I own this. They just continue to deliver simple growth. I’ve mentioned them before – airplane focused production of special alloys.