Week 46 LiveRocket

Many of our stocks are stagnating because the market thinks that there is better growth elsewhere. This is true of the commodity equipment stocks and oil service/equipment stocks. I don't tend to look for momentum for momentum's sake. I look for companies that have strong growth and upside potential based on their sectors or their own unique story.

Usually, the market and I are in agreement, so momentum tends to be behind these stocks as well. "You had a lot of people piling into the stock as a commodity play and when (commodities) turned south, people got out of it," said Charles Brady, a stock analyst at BMO Capital Markets. That's called sector rotation.

The problem I face is that I don't see where there is better growth. Also, I don't see strong market signals about where it sees growth. Given this set of circumstances, I chose a strategy that says that the market will return to favor and reward companies that continue to perform. Frankly, this strategy has not been successful so far.

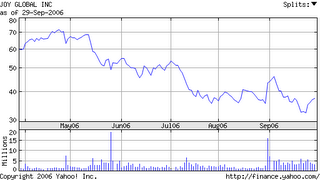

Consider JLG and JOYG.

JOYG announced earnings a month ago. They were on fire. They beat expectations by 9%, grew sales 16% and earnings 300% (and that's after deducting a one time $111M credit). Their margins grew from 28% to 32%. The cash position grew 46%. almost 40%. They raised guidance. They say demand for mining equipment is so strong that they are raising output by 40%. The reward - a scontinued softness. They have a 12 P/E and are expected to grow earnings this quarter 30%.

Or JLG. Same basic story.

Sales up, margins up, earnings up. We don't

own JLG or JOYG, but they provide good examples of the impact of sector rotation even with companies that continue to provide solid returns. I understand why the markets will take a dim view of construction (JLG) and mining (JOYG) - the massive growth is behind them. But I don't understand why the market thinks other industrials will provide better growth potential.

More confusing to me is the oil services and equipment side, because the business is still very much booming. Perhaps that is why these stocks have started to recover this week after getting pounded a week or so ago (caused by oil price drops).

This 6 month chart of DO is a textbook chart for a stock to avoid. While the technicals have improved, there is no love for this stock. Nevermind expectations of 70% sales growth and 300% earnings growth this quarter. Nevermind that today's 19 PE will drop to 7 next year - and that's guaranteed because these are longterm contracts with guaranteed payments.

So why do I stay in DO? Simple - because I know that oil prices always drop in October. Look at Sept/Oct period in 2005. The stock softened, only to rise almost 100% in 4 months. I don't expect that significant a run-up, but I am prepared for some softness. I can imagine oil prices to drop to the 50s before running back up to $70+.

So why do I stay in DO? Simple - because I know that oil prices always drop in October. Look at Sept/Oct period in 2005. The stock softened, only to rise almost 100% in 4 months. I don't expect that significant a run-up, but I am prepared for some softness. I can imagine oil prices to drop to the 50s before running back up to $70+.The other choice is to sell and then wait for more softening to buy back in. I think that the 15%~20% softness has pretty much already happened. Plus the significant upwards movement on Friday's down day was very positive for me.

At the moment, GLBL and GRP are the stocks having the largest negative impact. Not surprisingly, these are oil equipment companies. I have an 8 week plan for these oil stocks. Meanwhile, the tech stocks (T, TRID, ISIL, EMT, UCTT) are looking fine. We are going to sell EMT. It made ~6% but I had higher hopes.

ILMN was a surprise: after racing up ~20% it came right back down. No worries - it has the right momentum.

KSU and OCN are the unique plays. KSU because of the major role it will play in transforming the US/Mexico business infrastructure. OCN because of my desire to play the housing bust.

We have ~$10K in cash and then the EMT sale. Stay tuned for ideas.

More Tuesday - LiveRocket Turbo and others.

2 Comments:

Planning to buy some DO shares after today's 5+% dip -- I do hope this is just sector rotation and not necessarily wrong with the fundamentals. I am looking at 2-3 month investment (with DO earnings on 27th Oct btw!). Comments Andrew?

I think DO is fully dependent on the oil price - not the business fundamentals but the stock price. But watch for some exciting earnings results

Post a Comment

Subscribe to Post Comments [Atom]

<< Home