Are oil equipment and Services still investment worthy?

I see this as a profound buying opportunity and here is why.

Oil is a commodity with some unique characteristics.

- It takes a while to go from investment to yield (i.e. drilling to shipping barrels). As opposed to farming where it is easy to get more output quickly.

- There are substitutes at the fringes (coal for electricity, for example) but there is no substitute for mobility (planes, cars, boats) or petrochemicals

The result: supply and demand set the terms in a very clear way. It is my belief that in the short term:

- There are many new sources of demand, primarily China and India. Automotive and Airplane usage will drive up oil consumption in these two countries by at least 5% next year. There will be approximately 40M more cars on the roads in 4 years in these countries.

- Current demand for oil is running at 90m barrels per day. China and India consume 9m bpd. A 5% increase is ~500K bpd. Other countries’ consumption will easily drive this to 1m bpd.

- Current supply for oil is around 90 million barrels per day. Despite rampant cheating on quotas, major shortfalls by Venezuela, Indonesia and Iran (total miss 1.8m bpd or ~7% of total). The reason for these misses is underinvestment in infrastructure. In any case, oil production is maxed out: oil producing states are selling everything that they can extract. Current projects to increase supplies will add ~18% over the next 10 years.

- Current and projected demand will consume current and projected supply.

- There are many new sources of supply. New technologies can breathe life into old oil wells. Oil can be extracted faster from known oil fields through the digging of more wells (the US has over a million wells, Saudi Arabia less than 2,000). The return of former major oil producers like Iraq, Libya, and even Caspian Sea countries. Discoveries in other countries like Kazakhstan & Sudan. And offshore drilling. With the exception of offshore drilling, these new supplies are already factored in.

- Access to new oil supplies is very restricted. Most countries have nationalized the oil industry, so private oil companies must be more aggressive with exploration and discovery. Corruption in Asia Pacific is a major stumbling block to investing in exploration. After years of feuding, Indonesia and Exxon just signed a deal to move forward to produce oil from the massive Cepu field. With this finally resolved, more exploration in these areas may proceed.

- There are other supplies in the form of alternative fuels and fuel efficiencies. However, alternative fuels primarily substitute for coal, not oil, when it comes to supplying electricity to the home. In the case of mobility, there is no substitute. Biomass like Ethanol is not really viable without massive subsidies to US farmers. Hybrid cars merely present more fuel efficient ways of storing energy on the car, and hybrid represent a small percentage of new cars sold. The result is that any contribution to fuel efficiency and reduction in oil demand will be outweighed by growth in cars around the world.

Which is a long way to say: there is enormous pressure to produce and discover more oil fields.

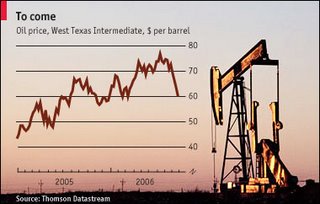

Short term oil price fluctuations are possible in a tight supply/demand scenario. A small movement either way has much bigger implications in the short term. For example, the usual slowdown of oil consumption in the US during the Fall is temporary but it is causing a slight - very -slight - build up in surpluses. The result - oil drops almost 10% in price.

Other real or perceived impacts on supply/demand have also played a role. Nigerian disruption, Iran sanction concerns, the Israel/Hizballah crisis, as well as the Prudhoe Bay worries, Katrina aftermath and fears of a return of Hurricane wreckage in the gulf. So we are returning to a more normal path. Notice that I discount the fears of an American slowdown affecting prices. A slowdown will reduce oil consumption but not as drastically as many fear. The plastics and petrochemical industries slow, and some industrial production, but people will still heat their homes as much and drive their cars.

The fact remains that these perceptions and real fluctuations in supply and demand can dramatically move prices at the pump. As you can see in the chart below.

From an investment viewpoint, however, month-to-month oil price fluctuations do not affect investments by big oil companies and smaller countries. Vietnam doesn’t care what it takes – they need oil revenue and supplies. They don’t care about OPEC quotas. The same goes for Russia – their economy is alive only thanks to oil. They will pump as much oil as possible. Oil is what keeps authoritarian governments in power.

What about OPEC claims to reduce oil production if the oil price falls too low? That is symbolic – an important gesture, certainly – but only symbolic. OPEC countries don’t want to reduce production. And they will cheat on quotas as much if not more. Notice also that OPEC control over world markets has dropped to almost 50% and that this drop is continuing. Their ability to influence world oil markets is strong but weakening.

So who benefits? Oil companies and refineries will make money, but their profits and stock prices will vary according to the oil prices. When it comes to extracting oil – pipe builders, drillers, oil rigs and shippers are in the catbird seats.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home