LiveRocket Week 13 Turbo Performance - down 1.6%

Here is the bi-weekly update on the 2 week performance.

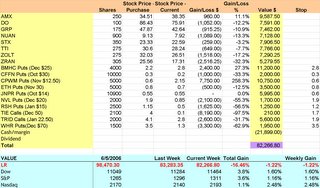

We have a portfolio value of $104,166. After Margin, that's $82,267. That's down $1K since 2 weeks ago.

Remember - this is a volatile portfolio. Especially the options. For that reason, I review only bi-weekly.

Here is a review of the stocks and options in the portfolio:

AMX: Still creeping up. They are susceptible to Mexican politics but overtime this should be a nice addition.

DO: Some improvement since 2 weeks ago. There was weakness until this week and suddenly the market renewed interest. In fact, the technicals are very hot.

GRP: Still flatlining. Neither up nor down. Still down 11%. Patience is the key here.

NUAN: Still flatlining. Neither up nor down. Still down 13%. The trend to go to voice is very much alive. The question is whether NUAN will get the most benefit. Blackberry announced their voice move http://yahoo.reuters.com/news/articlehybrid.aspx?storyID=urn:newsml:reuters.com:20060901:MTFH60034_2006-09-01_21-30-51_N01448384&type=comktNews&rpc=44

But they aren't using NUAN. In any event, cell phones and voice recognition make perfect sense. Text entry is a pain with cell phones. However, major market acceptance is still years away. There are also various rumors here regarding Microsoft entering the market with Vista and giving away voice technology. MS is no threat because PC voice-text is not competing with NUAN. If anything, MS will be accelerating market demand for voice based text entry by introducing it to millions of users. Also, NUAN targets the business users and they will not tolerate the faulty MS speech quality. It will be easier for them to move downmarket to GPS and cell phone devices.

STX: Nice recovery. We were down 8% and now down 3%. I think the slight downturn 2 weeks ago was caused by insiders selling 5M shares 2 weeks ago.

TTI: Some slight improvement. TTI seems stuck at $28. I guess we have to wait for another stellar quarter.

ZOLT A great rebound. We were down 37% and have recovered to being down 'only' 17%.

http://finance.yahoo.com/q/bc?s=ZOLT&t=5d&l=on&z=m&q=l&c=

The volume the last 2 days has been strong. Possibly some squeeze plays (it was the end of the month). I notice that several farms in Iowa are looking to build major windfarms. The largest user of ZOLT's carbon fibers is wind blades for wind farm wind mills. The economics of the windmill are driven by blade size. Bigger is better. And at a certain size, carbon fiber is the best material.

ZRAN Still down 33%. The recent class action lawsuit didn't help. I don't think these lawsuits will go very far. Meanwhile, ZRAN will continue to hit afterburners.

Notes: 1 - an option contract equals 100 shares and the listed prices are per share

2 - Current option price is the bid price (the price you would get, which is lower than the price you would pay)

TIE Calls (Dec 50) 21 contracts @ $4. These are almost worthless, so we are going to hold on to them. I think TIE is poised to make a solid run up, which would make these recover a bit.

TRID Calls (Jan 22.50) 20 contracts @ $4.1 What a difference 2 weeks makes. TRID almost hit $22. And on strong volume. We have 5 months of life here and I can see $30 before January easily. That would be a good pop up.

BMHC Puts (Dec $25) 40 contracts @ $2.2. BMHC keeps staying above $25, which is ridiculous. Patience will be in our favor. We are up some, but I see us being up a lot more.

JNPR Puts (Oct $14) 109 contracts @ $0.55. JNPR has remained at $14 after falling towards $12. I expect them to lower expectations between now and October, and we will be ahead again.

CFFN Oct $30 puts 100 contracts @ $0.3. Now at $0.2. Ridiculous. I feel stupid for not finding a better sub-prime bank to short. I think we will just accept the loss and look at shorting WAMU.

ETH - Nov $30 Puts 50 contracts @ $0.8. This stock has surprised me. It is resilient, but it will crash back down. It has only bad news to offer investors.

WHR -Dec $70 puts 15 contracts @ $3.5. Same as ETH. Patience will pay off.

CPWM - Nov $12.50 Puts 50 contracts @ $0.6. CPWM recovered a bit but that's in the short term. There is no goo dnews as we head into the holidays.

NVL - Dec $20 Puts 20 Contracts @ $1.9. It droppde below $19 this week before rebounding 10%. More bad news but the stock moves up. The CEO was fired. They are closing some European offices and taking a write off. Earnings for 2006 were lowered even further. But this dog moves up. It's only a matter of time.....I think the <$19 drop was a sign or more to come as they test the downside and bigger investors pull out.

RSH - Jan $15 Puts 25 contracts @ 1.15. They got some publicity this week for firing headquarters staff via email. Meanwhile, the stock moved up - people like to see a leader take charge and do some house cleaning. I think it is just lipstick on a pig, and we have a few months to see.

Supposedly there is a bid to take RSH private. That rumor helped investors even though it was strongly denied.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home