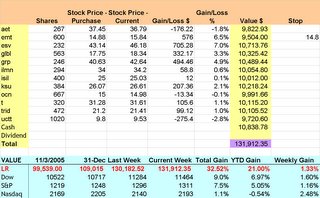

Week 42 LiveRocket Performance up 1.33%

We bought back in Thursday and our 2 day yield was pretty solid.

I mentioned that I wanted to buy LEAPs instead of shares and that would have been a very nice move for the week, probably adding 10% thanks to the oil/gas equipment companies. However (there's that dreaded H word) I keep thinking that LiveRocket should be strictly shares and Turbo is where we do more exotic option plays.

In addition to the shares, we still have ~$11K in cash

AET - Down on low volume. I like that one of the Sr VPs just bought $1M worth of shares in a Direct Purchase. Indeed, the MACD has turned positive for the first time since April - indicating a more positive environment.

EMT - EMT moves with the Latin American markets. In any case, we are going to lock in some gains and move on. There is an upper limit of $16 on this stock due to the buyout offer. We will earn ~7% in a few months.

ESV - Up 7% in 2 days and on solid volume. All oil rig companies are doing well. More contracts are showing a virtual bidding war for rigs. Also boding well for the future, the technical aspects of this stock have stabilized and may begin trending positive. Considering the 7% gain, that's exciting.

GLBL - Up 3.3% in 2 days and 5% in 1 week. Volume was also good. What I like about GLBL is the sizeable cash build up.

GRP - Up 5% in 2 days (after bouncing off $40). Of all the oil equipment companies, GRP seems to have the best cash position.

ILMN - Enjoyed a little bump up, possibly due to a Motley Fool mention. Remember, this is a risky choice not only because it is small and in a niche market, but there is a lawsuit.

ISIL - This baby is back. I meant to buy closer to $23 but wanted to see it bounce off and move up. It did.

KSU - Nothing to report.

OCN - We bought after a downgrade brought a 11% correction. The play here is the foreclosure market. OCN, for example, is the #1 handler of VA foreclosures. Sadly, many veterans are not on solid financial ground and are very exposed in a housing downturn. I think that this is the right play, but I want to be careful. This one is a risky choice.

T - In choosing between T and Q, I went with the dividend payer. Also, I like T's positioning with Cingular because cell phones seem undervalued to me. One thing about T - the MACD has been a powerful predictor for the past year. It is flattening out.

TRID - We are getting into their prime season. Lots of positive news should push it up strong. Especially if the GDP stays above 2%: investors won't be as worried about consumer products at that level. Strong volume and the technicals are also showing strong interest in TRID

UCTT - No news. This is a thinly traded, small cap stock. But Those are the ones that grow and offer us the earnings surprises

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home