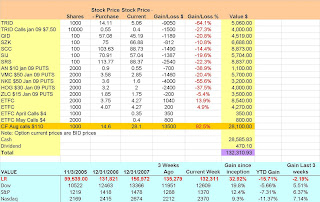

I overweighted the bear too soon. But I wasn’t sure, so, to be on the safe side, I made sure to remove the time factor. The puts expire in January – 9 months away. Prior to that time, a 15%~20% drop in prices puts us a bit ahead. I fully expect that.

Moreover, the ETFs don’t expire.

Time is on our side without having to worry about timing.

But the impact on value is high – the bear move comes at a 20% drop in price. Fortunately, we are doing well on the other half of the equation: short-term long positions.

Yet again, the STOPs hurt us and got us out of stocks prematurely. So I used that cash to buy options – the best way to get fast returns when a market is moving strongly – up or down, it doesn’t matter. If you notice, the puts are 9 months out (closer to 10 when bought). But the calls are 1.5 months (ETFC) and 4 months (CF).

We’ll be doing more of that when the time is right: in and out. Using 20% of the portfolio, I will be jumping in and out of options with one goal: a 10% profit. The CF play yielded ~100% return or $14K in 1 week. I don’t think we’ll repeat that anytime soon, but I think we can achieve 10% from time to time. That will contribute 2% to our performance. This is very risky: I firmly believe that this rally will end and I don’t want to be stuck. Meaning: covered calls may not be the play of choice.

An important note on how I am accounting for ETFC. We own the shares and sold the calls. I am booking the calls and will add to cash (which it is) next update. I will continue to record the ETFC at current market price until expiration or exercise. There is always the chance that it could be <$4 in May. I am also targeting MVL calls. The June $30 calls are $1.25. MVL trades for $27. That’s 4.5% of the underlying stock. The $25 calls are $3.50 or $1.50 minus cash for the $27 price. (The extra $0.25 or 1% is the reduced risk premium because the option is so far in the money.) MVL hasn’t seen $30 in a year, much less the $31.25 that is needed to breakeven. I think we are heading to a breakout to $29 in the next 6 weeks. Why? IRON MAN releases May 2nd, 3 weeks away. Now, MVL is not a big studio that releases 10 or more movies a year, and so a dud is balanced out. MVL is depending on 2 movies this year: HULK 2 and IRON MAN. Failure will be a problem from the standpoint of expectations. That is, the financial downside is capped: MVL borrowed the money and the collateral is future IRON MAN movies. That is – they have no losses to record. Heads – they make cash and tails, they lose no cash. But if it isn’t a flop, they get all the profit. ALL OF IT. DVD sales, TV rights, a new cartoon for the kids. And especially Toys. SPIDERMAN is a billion dollar franchise. If they can do IRON MAN at 20% of that, they are ahead. MVL had ~$500M in sales last year. A $200M movie increases sales 40%. That will pop the stock really hard. Unlike the rest of the movie industry, MVL will probably be very forthcoming about the film’s profitability because it enhances their stature and the opportunities on future movies. Then, in June, the next HULK releases. Now, here’s the kicker: current 2008 earnings/sales estimates do not include IRON MAN. From the last earnings release: “As announced last November, Marvel's 2008 financial guidance does not include revenues or expenses related to the box office, home video/DVD, TV or media sales performance of its self-produced Iron Man and The Incredible Hulk films. Marvel's 2008 financial guidance does reflect the overhead costs related to its film production business” Current estimates have 2008 earnings contracting 5% on flat sales. Which is absolutely moronic: IRON MAN will do at least $100M in sales: action movies always do. The TRANSFORMERS movie grossed $700M. Assume that IRON MAN cost $150M to make (the same as FX heavy TRANSFORMERS). SPIDERMAN generates $150M opening weekend. IRON MAN could do half as well, and that will juice up the stock. And there’s the HULK 1 month later: more sales.

Even a lame movie like THE PUNISHER earned $34M. And it had no real special effects, unless you consider Travolta’s acting to be computer generated.

MVL will top $1B in sales by virtue of these new movies and related merchandising. What about earnings? With 78M shares, a $40M profit adds $1 to EPS. That’s a 60% jump

Surely between THE HULK and IRON MAN, MVL can add $40M in profit in the next year.

So bring it back to the options. The buzz happens in May and then June, when the movies release. A sign of a hit will jazz the stock. Going out to June locks in 2 movies. We only need 1 hit to get folks excited.

I sure am excited.

------------------------------------------------------------------------------------------------------

Over the past few years, we have been a nation whose economy was driven by people buying and selling homes to each other. We imported and borrowed to enjoy the gains that really weren’t there. Massive amounts of capital and resources were misallocated to housing and the financing.

In essence, the last 6 years were a joke economy – we produced very little and ran up a lot of debt. Now we have to pay that back. No amount of window dressing by Congress of the Fed can possibly change this. The best that can be hoped for is a delay or a softer crash.

Right now, the current belief is that this will be a soft and short recession.

Well, maybe it will be and maybe it won’t be. If it is not a soft crash, imagine the pandemonium and fear.

Meanwhile, what makes us think this will be a soft crash? Are companies and consumers going to spend?

1. US Housing market continues to crash. What can prop up prices?

* Interest rates aren’t dropping: the Fed has cut rates from 5.2% to 2.25%. Mortgage rates haven’t budged.

* Prices are dropping and will continue to drop as foreclosures rise and homebuilders slash prices.

* Government intervention. Freeze rates or foreclosures are some of the chatter, but it won’t happen. And if it does, it will drive away more foreign investors which makes mortgage writing more expensive.

* Global housing markets are starting to crash. Ireland, Britain, Spain, New Zealand, canda, Australia: the news is that prices are dropping in the double digits. So much for the global investor racing in to buy housing

2. Government aid

* $1,200 in taxes on the way. That’s nice, but it won’t do much

* Special tax leniency for companies: they could waive taxes on lenders, homebuilders and others. Not sure how this can help since all of these companies are reporting losses and won’t be paying taxes

* Free money to banks. This is actually helping in the short term. Helicopter Ben at the Fed has been giving money away to Investment Banks who are then speculating with it on Wall Street. This will help them in the short term: their assets look more profitable on the books, just in time for the close of the quarter (last week). They also get more action from retail investors, more money from transactions and margins, and even some cash profit potential.

A happier Wall Street has a way of making people feel more like spending (the Wealth Effect).

But these are all delaying tactics, at best. The core economy is slowing and nothing will stop that. The lending has gone to Wall Street gambling not to lending.

3. Consumer Spending is crashing

* Retailers report slowing business. First it was the low end: Target, Zales, and so forth. Then the higher end: Nordstroms, Tiffanys.

* Anecdotally slowing of discretionary spending. Ladies in LA and New York are putting off Botox treatments (AGN is a nice short right now for that reason.)

4. Manufacturing investment is slowing

Here’s a piece in the SF Chronicle.

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/04/05/MNI1VS96B.DTL“As the nation’s housing market swoons, lenders are tightening their grip on their money. Last month, that credit crunch reached Brent Meyers.” “He owns a substantial investment portfolio and a million-dollar house in Moraga. He pays his bills on time and has no credit card debt. His credit score, he says, is around 800.”

“But in mid-March, Bank of America cut off his home equity credit line of a little more than $180,000, citing a decline in the value of his property. Meyers is now scrambling to come up with $75,000 to pay for a major landscaping project and is canceling other big spending plans.”

“‘My wife would like a new car, but that’s going to have to wait,’ he said. ‘We’re taking a $75,000 cash-flow hit, and I want to boost savings.’”

“As home prices started to sink…lenders including Bank of America, Washington Mutual and Countrywide Financial cut back on home equity loans to reduce their exposure to the housing market. ‘These are unprecedented market conditions,’ said Bank of America spokesman Terry Francisco.”

Tight lending is affecting the wealthier folks as well. According to the Fed, Home Equity Loans dropped from $185B in 2004 to an annualized $100B in late 2007. It is probably dropping further. That means retailers are going to get ~$100B less money this year than they did 3 years ago. That’s why we are short Consumer Services and Consumer Goods.

Take that debt servicing and add in rapidly rising unemployment and expect further belt tightening. Which becomes the usual recessionary spiral: business will stop investing. Yesterday, American airlines announced a hiring freeze. What comes after hiring freezes? Yep, layoffs. Expect accelerating unemployment to be widespread in 6 months and especially in January 2009 (American employers usually wait ‘til after the holidays).

There already is massive unemployment, but it is not recorded because it started with illegal Mexican immigrants. From construction crews to landscapers, the Mexican laborer has been hard at work. And starting last year, they began to get fired. Easily 500K Mexican workers have been laid off. There is a net outflow from California to the Midwest as workers trade construction jobs for farming (the only booming sector for manual laborers).

But that cushion has run its course and now legal workers are getting fired.

This is not a doom-and-gloom story. I’m not trying to paint an ugly picture. I am trying to be realistic and invest accordingly.

I don’t believe the official information because it is normalized – the US government does not use raw data but manipulated data to address seasonality. In a transitioning economy, however, that seasonality estimation fails. That is why the experts suddenly added 67,000 more unemployed workers to January and February and how they were surprised that March was 80,000 unemployed instead of 65,000.

The government data missed ~100,000 newly unemployed because of the way it estimates unemployment. It means that things are worse than government data shows.

So why invest as if things are rosy? Invest in places that benefit from a downturn. Be grateful that everyone else is betting that the bottom has been found – that makes the short opportunities even cheaper.

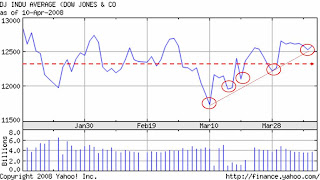

Since March 10th the lows keep moving higher. Which is a positive trend.

Since March 10th the lows keep moving higher. Which is a positive trend.