With a great year for the global economy in our pocket, what do we have to look forward to next year?

The stock market is looking for continued growth and falling interest rates. Certainly most people are not feeling any pain and do not have a reason to be concerned.

Nevertheless, the US economy is downshifting. Depending on your timeframe, the economy is either fine or heading for a recession. Whatever you think, the winds are dying down and we need to find companies that can paddle strongly.

Second, a housing construction slowdown.

Third, China and India are booming and will continue to grow regardless of a US led recession.

Fourth, High Tech lacks convincing new hardware.

Fifth, the traditional sectors to invest in now are financials, healthcare, and consumer non-cyclicals.

Sixth, the sectors traditionally avoided to stay in: aerospace and energy/commodities

Seventh, the Iraqi war could begin to wind down, which is bad news for the military-industrial complex.

US ECONOMY DOWNSHIFTINGA slowing economy means a few things. Less consumer spending, rising unemployment, and interest rate softening. What are we seeing at this moment in time?

Consumer spending still sound but cracks are appearing especially at the low-end. Massive discounting and longer hours this year pulled in strong retail sales, but Walmart troubles signal what the future holds. Strong sales at weaker margins. Avoid retailers and especially big-ticket item manufacturers, like cars. Garmin is not going to look good for much longer.

Unemployment picking up. The numbers last week were 20,000 higher than expected. Housing construction layoffs in September were 26,000. Unemployment will pick up after the holidays but will initially be very focused. It will be very housing boom focused: construction, real estate agents, and bankers. As these jobs dry up, so will the retailers and restaurants that served them.

Interest rates ready to soften Inflation is picking up and that will slow interest rate reductions, but those reductions will happen. I would say 0.5%~0.75% by the end of 2007. I do not expect rapid rate dropping. Some people point to the need to maintain dollar strength by keeping rates high (something I reject because a lower dollar facilitates US exports, something critical in a slowdown, and pressures China’s much delayed changes in exchange rates). Other people see inflation (remember: the Dems want to raise minimum wages), and so do I, but I also see deflation. Katrina added to a lot of the past 12 months of inflation, just as its passing has led to lower prices (lumber is now at a 5 year low).

The current economic cycle was made possible largely by China’s manufacturing strength. That enabled US manufacturers and retailers to keep prices low and enjoy strong margins. As the economy winds down, manufacturers and retailers will be caught trying to pass on higher prices to consumers at a time of slowing sales. They won’t get away with it.

While growth can continue, overall sales growth will slow. More downside than upside.

HOUSING CONSTRUCTION COLLAPSINGThere are two parts to this equation: housing construction and housing sales. Housing construction is the millions of people hired to build homes using billions of dollars of lumber, Home Depot Kitchens, windows, and so forth. Not to mention the Ethan Allen furniture and new fridges. Housing sales is the amount of wealth homeowners felt as home prices soared and homeowners took out loans.

Here’s how the dominos stack up in a home building collapse. Around 500,000 construction workers and suppliers will be laid off. They will not buy cars or new toys. Secondly, manufacturers and retailers will slowdown (demand for granite kitchens is tapering off rapidly). Don’t think so? A lumber supplier in Stockton just shut its doors (30 people laid off). This means lower spending on consumer items. This will be apparent by the Spring.

In the case of homeowners, falling house prices historically make people more inclined to tighten their belts. This time is different because a significant number of people are sitting on large equity profits even if prices fall 30%. But with prices falling, they will still be less inclined to spend as much.

This will lead to less consumer spending.

Most vulnerable are lower income workers and tradesmen, as well as real estate agents, bankers and retailers.

White collar professionals are largely insulated except for those who bought homes using an ARM. These folks will be in trouble.

The current mantra in the housing market is that there will be a Spring rebound in pricing. Everything rests on that hope. Imagine all the people who will try and dump their homes in the Spring and expect prices to stabilize in the face of surging inventory and a slowing economy.

Common sense says that the housing boom was 100% caused by excess liquidity and speculation. That is, money was super cheap, that homes were almost free. It will be tempting for the Fed to drop rates again to keep the economy humming away, but dropping it down low makes sense only to those looking to sell homes.

CHINA AND INDIA AND JAPAN, OH MYThe global economy no longer flies solely on the US engine. China and India, as well as Brazil, Russia and Eastern Europe are all catching up on their infrastructure and making long overdue investments.

This is good news because this will lead to demand for US products and services.

The global economy means that a US recession need not be as deep a hit on corporate sales as it might have been in the past.

HIGH TECH HO HUM

There isn’t much happening in high tech. We are at the tail-end of the digital and internet waves, with the boom currently focused on traditional entertainment migrating over. Products like the Apple iTV or Microsoft’s Vista are nice, but aren’t going to drive much in 2007. That is, they will be released in 2007 but won’t have much impact until 2008. Even the PS3 will help but not much. True new products like 100% Flash Video Cameras or Mobile TV on the cell phone are still far away.

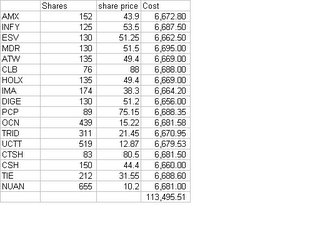

There are bright spots on the horizon. Personal entertainment will continue to drive demand for flash and hard drives as well as lcd TVs. Look for digital entertainment distributors like Akamai to continue to do well. Also, continued growth of cell phone usage in other countries (think AMX). In the US, competition between cable and traditional phone companies will make Sprint an attractive buy, and fuel more fiber cable deployment.

INVEST LIKE THE BUSINESS CYCLE MONGERSAt this point in the business cycle, smart money is fleeing manufacturing before things turn down. Instead, it’s heading to healthcare, financials, and consumer non-durables.

Healthcare has been the single highest returning investment of the past 30 years. Hugely profitable. And there are incredible niche opportunities here. Avoid big pharma with the Dems in power. Focus on cutting edge technology oriented companies.

Most banks will weather the housing collapse well. Some, like Countrywide, built their entire business on mortgages and they are not sitting pretty. But many are looking at booming business from a massive wave of re-financing and lower interest rates. A higher default and foreclosure rate will affect the equity markets (remember the S&L crisis impact). I especially like institutions aiding in LBOs and M&As. GHL has surprised me – they are up despite having plans by insiders to dump millions of shares and having a 27% short ratio. Or maybe it’s because of the short ratio……GS and LAZ look tasty.

Insurance companies are also looking good. Higher premiums and lower payouts (hurricane season came and went, no major blizzards yet). Will this last? Folks simply can not get away with no insurance, especially on their overpriced homes. I like STA for insurers.

Investing in consumer non-cyclicals puzzles me. It’s a purely defensive move – why on earth would P&G do better in a recession than in a boom? Or Coca Cola? This one makes no sense to me. People have to eat, yes – but that doesn’t translate into more sales of food. And I want to invest in growing businesses, not park my money waiting for sunshine.

Two exceptions to the rule of the business cycle are aerospace and the energy/commodity plays.China and India are booming for airplanes. And that means Boeing. Airbus is crashing hard and Embraer doesn’t have what it takes to compete. Smaller planes are a niche. Boeing is unstoppable. And so is PCP, a Boeing vendor.

Energy and commodities are very much oligopolies and they do business deals that lock in prices for years. Mines in particular are deliberately underinvesting to prop up prices. This is the mid-way point o fthis boom, not the tail end.

Energy demand is soaring. Even if the economy slows, every year more people are hooking up to the grid and driving cars and flying planes.

Break energy into two areas: electricity and fuel for transportation. There are many alternatives for electricity: coal and nuclear being the top ones, followed by wind and solar. But for transportation, only oil produces the right bang for weight. Ethanol is a joke.

Coal – Coal mines lead for generating electricity and demand is continuing to surge. Coal companies look great but coal is abundant and globally well distributed. Coal is also used in steelmaking, another reason for high prices. But I tend to avoid commodities, so I don’t do coal. One way that I have liked taking advantage of coal demand is the coal mining equipment (JOYG & BUCY) and coal-fired electric generators (MDR leads the world in coal generator scrubbers). JOYG and MDR straddle several markets (JOYG is in all mining and MDR is also in the oil equipment arena).

Nuclear – Other countries, notably China, have no qualms relying on nuclear power. Indeed, nuclear is the best choice China has for a population and industry getting more on the grid. Uranium is through the roof, especially since CCJ experienced mining problems. Again, tho, it’s a commodity. But someone has to build the nuclear reactors. Again, MDR is a leader in this area, providing heat exchangers and other equipment.

Oil – Inventories are tight and the market knows this. Why else has oil stayed at the $60 price even in the face of slightly rising US oil inventories. And it is slight – only a 2% gap between supply and demand.

As always, I prefer to focus on oil exploration and extraction, especially offshore. As I’ve pointed out previously, oil exploration focuses on offshore drilling. There is some potential for the Democratic led Congress to throttle back on the US offshore drilling rights (they want no drilling in less than 150 miles). IO for seismic location (high risk tho), ESV and DO for extraction and GRP for the drills. Oil refineries also look interesting.

It’s difficult to see much growth in Military spending. Lockheed martin, raytheon, general dynamics, Northrop will get hit hardest. Boeing will be affected but less – demand for planes continues regardless, especially for next generation titanium intensive fighter jets. Big ticket items will slow but anti-terror (aka homeland security) will grow.