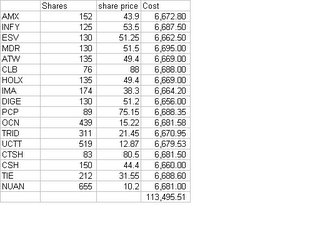

Bought Today Part 2

I bought today for 2 reasons

1. Better than expected GDP numbers.

2. Higher oil prices

GDP strength was better than I expected, and that will boost stocks. It also gives some ooomph to the market during a slowing period between earnings. Also, this will drive oil stocks up, as will the wintertime (I told you that oil prices would surge once the first cold storm hit).

GDP strength also gives a lot of room for the market to continue to discount the terrible housing news.

Of these stock picks, the most concerning to me is CSH. I want to watch how they weather the unemployment jump - it might affect their check cashing business.

Meanwhile, the weak dollar throws out good and bad. It is inflationary - imports are more expensive and dollar denominated commodities rise in price. It is also bad when trying to sell our bank notes - higher premiums are charged when the value is falling. It is good from a trade balance perspective by slowing the purchase of imports and for accelerating exports. Do we punish China by making their dollar bonds worth less or by making their exports to the US harder?

Put another way, which is more important to the Fed: raising rates to keep folks buying our debt or leaving rates alone for our economy?

2 Comments:

I don't see any exchange related stocks like ice,ise,nyx,nmx in LR

Alos i don't see casino related stocks like het,lvs in LR

rumors on M&A on ESV,DO ..

Post a Comment

Subscribe to Post Comments [Atom]

<< Home