Liverocket Portfolio - Updates

Sold DSX and MGM Puts. Took a small loss on the DSX (got bottom-ticked) but the MGM wsa a sweet return. The proceeds are not yet added to the cash position.

Everyone has opinions. They give you their two-cents worth. I'll give you more. One penny more. That's a cool 50% more than others. And that's wicked value. The LIVEROCKET investment philosophy is that at any given time, there are amazing companies out there that are building better mousetraps and generating incredible sales. This is not a buy and hold philosophy. No company can maintain exceptional growth and momentum for long.

While an oil crisis is good for spurring innovation, it takes years to affect the existing energy market.

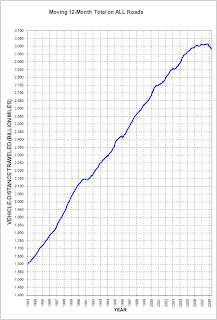

Oil consumption is affected by manufacturing and cars.

The Chinese car market is growing ~2M units per year.

There is less than a 1M bpd surplus in the world today.

There is less than a 1M bpd surplus in the world today.

(http://www.eia.doe.gov/oiaf/forecasting.html)

But that 0.8M bpd is quickly eroded by new demand. A barrel of oil yields 20 gallons of gas. 5M cars on the road will consume 1 gallon a day (terrible traffic consumes a lot of oil) or roughly 0.25M bpd. Add in growth in emerging markets from manufacturing, airplane travel, and so forth, and global increases in demand reduce

Meanwhile,

Factor in the scarcity of refineries and you see a transportation process that moves crude oil to a refinery and then to local markets. The remainder service

Getting back to oil – supply is very tight today and for the next 12 months. While dollar weakness and speculation has played a part, the reality is that underinvestment and sudden demand are the real culprits.

The real issue is electricity. Factories run on electricity. Air conditioning, hospitals, the internet, infrastructure – it all needs electricity. And coal and natural gas generate the bulk of electricity in the world.

Half of the

Meanwhile

This is not going to stop for some time. And there are bottlenecks which create mini-shortages - like limited transportation routes and ships, like weather around East Coast or West Coast ports, and so on. DSX is a contract drybulk shipper - they pass fuel costs on to customers, so oil i snot an issue. And they are the ones who benefit from this demand.

Natural gas is in a similar shortage.

NG is used for heating, electricity generation and for fertilizer. The

http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7045418

So all roads seem to lead to

I think earnings will blow away all expectations and I like the recent pullback for an opportunity to buy oil extractors and services, NG extractors and services, coal, and shipping.