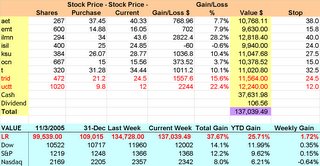

LiveRocket Week 48 Performance: up 1.72%

The first order of business, we have new STOPs and a mountain of cash. I am keeping a tighter-than-usual STOP price, and I'll explain why as we go along. Also, we were stopped out of TRID and UCTT, and now we have just over $60K of cash. It is not my intent to keep 45% of our portfolio in cash, but for now I am being cautious about jumping back in.

The first order of business, we have new STOPs and a mountain of cash. I am keeping a tighter-than-usual STOP price, and I'll explain why as we go along. Also, we were stopped out of TRID and UCTT, and now we have just over $60K of cash. It is not my intent to keep 45% of our portfolio in cash, but for now I am being cautious about jumping back in.I am sensing signs of a slowdown in the earnings releases. The earnings expectations are high - what you would expect for a strong economic cycle. But the blowouts are few and far between. GOOG is the exception, not the norm.

Here's what I mean

3M beat by 5%

CAT miss by ~15% (and lowered forecast)

KO beats by 5%

HCA miss by 10%

SLB beat by 6%

BofA beat by 5%

Baxter beat by 2%

BRCM met but forecasted slower sales (and slowed sequentially from previous quarter)

C beats by 7%

LLY meets

Equifax beats by a penny

GOOG beats by 10%

McDs meets

UPS beats by 7%

AAPL beats by 22%

Boston Scientific beats by a penny

ET misses

Illionois Tool works misses

And on and on.

Yes, these are signs of a strong economy. Most companies are hitting growth targets.

BUT they are not crushing the targets. GOOG has beaten by over 10% for 4 of the last 5 quarters, although they were technically just under 10% this quarter.

This was CAT's first miss in 4 quarters of beating earnings. Same with BRCM.

Just looking at the degree of hitting/missing earnings forecasts can be misleading. If you look at the majors and consider the last 5 quarters, you won't see a trend. Most of these companies are so large and so well covered that the analysts tend to hit the number. Or, to put it another way, these large companies guide them to the number.

You also have to look at the projected growth. And the answer is: projected growth rates are LOWER than last year's. They can beat lowered targets. Look at INTC.

That is another reason why CAT wsa such a shock. This is a bellwhether company because its customers form the bottom rung of the economic chain. The miners, extractors, construction companies, and so on. They are industrial in a way that 3M office supplies and KO beverages is not. So this carries a lot of weight as a precursor of thing sto come.

Another sign that I see is the chip slowdown. I have been under the premise that Vista will boost PC chip companies and related companies, as will the Playstation. In the near term, however, there is a slowdown and it is being felt. The only rapidly growing consumer tech device is the flat panel TV.

Will this be a pause before a run up? I don't know. The signs are mixed. Hello uncertainty, goodbye stock prices.

In any case, I am reading the signs and I believe that the general theme is one of impending slowdown. Not a drop in sales/profit, but a deceleration in growth. The precursor to a recession. And this is the quarter before holiday shopping - this is when inventory stockpiling began and sales should have been great, not flat.

Now, compare that with the general tone of the market, which is up-up-and-away. Money has fled gold and real estate, and heading back to equities. The drop in oil has helped to spur hopes of consumer spending. But supposedly oil will shoot up as of Nov 1st when the Saudis turn off the spigots. Right now, the market is laughing at the Saudis - expecting them to fudge - and that's anothe rreason for excitement. It keeps inflationary pressure down. Will there be widespread cheating? Maybe not - most OPEC countries are already pumping at max capacity. It all comes down to the Saudis who have shown the discipline in the past.

Inflation is here. Sure it is moderating in many places, but it is still very present and if it sticks around another month, another rate hike is likely before December.

And then there is housing. Remember, people are getting fired at this very moment: bankers, real estate agents, and construction workers. Many others are hanging on by their fingertips and they will be pushed off by January. This will slow the economy as well. Watch for loads of BMWs and jetskis to hit the used market.

Against this backdrop, I am concerned about false hopes getting dashed. This is very much a market moving up based on strong growth expectations versus my moderating growth expectations. As always, I concentrate on the stock, not the broader market. So I am hoping that a market crash post earnings season will give us good buying opportunities. Hey, after a 10% run-up in 3 months, a pullback is possible, so lets be prepared. I am doing that through tight STOPs and sitting on some cash.

---------------------------------

AET - up 3%. Volume is light, but the MACD is strong and the RSI is right where we want it. Earnings are due Thursday, and expectations are for a 20% growth. Watch for improved profits and the renewed focus on medical costs. I am not sure how a slowdown in employment could affect them. In any event, we bought based on overselling - this is not intended to be a long term holding.

EMT - Flat. They have gone beyond the TELMEX offer price of $16. earnings release Tuesday and expectations are for 50% growth.

ILMN - Up 23%. I already reviewed them, but I thought it worth pointing out that they held their price for 3 days after earnings release and on strong volume. They also ended near their 52 week high. I think that they just broke through the ceiling and will begin selling a great number of devices to big pharma. With any luck, this horse will run for a year or more.

KSU - Up 1%. They spiked midweek up 3%. Earnings are Oct 31st, expectations of 1000% growth (from $0.02 to $0.22). This one is interesting because the range of expectations is actually all around the map: from $0.14 to $0.27. I think they beat by a few pennies.

OCN - Up 1%. They had two major buyers midweek - someone bought 300K shares late Tuesday. They report Oct 30th, and growth expectations are 100%. The assumption here is that they help banks handle foreclosures and sub-prime refinances. And foreclosures have tripled lately.

T - Up 3%. Cingular tripled earnings, at the expense of Sprint. Now watch ATT show incredible strength. I think we missed the beginning stages of their rise, but we are on it now. The Bellsouth delay is holding them down as well. Earnings release Monday is for 22% growth. I am thinking that they will surprise and show margin growth.

TRID - Stopped out. But that's ok - they kept falling and on strong volume. Earnings release Wednesday, expectations of 100% growth. To buy or not to buy - that is the question. Will consumer spending slow OR will flat panel TVs continue to leap off the shelves. I am voting that they will leap off the shelves. I think the stock price is showing pre-earnings nervousness. I think money managers see that TRID ran from $15 to $25 in barely 3 months - lock in profits and wait and see.

UCTT - Also stopped out, but I think this is a pause. They hit a 52 week high on Monday, so a pullback is natural. They could bounce off $11 for a bit and move up, but I doubt it. Their earnings release Monday, and the numbers are incredible. The only question mark is forward guidance - but my gut says that they are going to have positive surprises there as well. The secret here is that UCTT is not followed by Wall Street very much - just 3 analysts. They continue to show amazing growth but have a tiny P/E. I say we jump back in Monday

Cheers!