Consolidation or Start of a Down Turn??

(MVL, WLT, ACI among others).

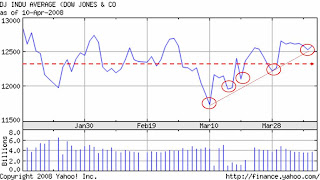

Look at the Dow in the past 10 trading days:

March 31 +45

Apr 1 +391

Apr 2 -45

Apr 3 +17

Apr 4 -17

Apr 7 3

Apr 8 -36

Apr 9 -49

Apr 10 +55

Apr 11 -180 (so far)

I'm not a technical trader, but clearly the sentiment is negative when 5 out of 8 trading days are negative and the 3 remaining are barely positive (+3 on April 7th????).

Now look at the 1 month view: things look positive. The lows keep getting higher:

Another thing to note: for the last 3 months, the market oscillates around 12,400 (the dotted red line above).

My interpretation is negative: collapse is imminent. nothing is really movingth emarket up after 3 months. During that time rates have been cut deeply but the market isn't moving.

If the market isn't moving up, what is the likelihood that it will move down? I think the likelihood is very strong. Because the bad news is spreading. GE announced poor earnings today, mainly in consumer durables in the US. Now add in the raging inflation that was just reported. March import prices surged 2.8% (10% for oil alone). I mentioned that I think people are buying less but spending more and that's your proof.

With the exception of oil services and agriculture, I doubt any companies will show strong earnings releases.

Further, I don't think that the current market P/E levels have baked in a string of lower earnings.

Meanwhile, the hope is that a downturn will reduce demand and thereby reduce inflation. Not likely. Oil and food are global in demand, and demand is rising. Furthermore, most of the price increases are tied to the weak dollar. that dollar will stay weak unless:

1. Trade deficit improves (imports drop and/or exports rise): not likely

2. Interest rates rise: possible, but the Fed would be run out of time

3. Europe, Chindia recession: very likely, but not for another year.

Inflation will continue and further weaken the economy.

Prepare for Stagflation: high interest rates and a weak economy

5 Comments:

Met someone close today, He was very bullish on a home builder stock that he is holding on profit but not ready to sell it .. to avoid capital gain tax. The only reason for a lower capital gains rate that makes any sense is that it's offsetting the loss of value due to inflation during the time you held the asset. If you buy a $1000 worth of stock and sell it after 5 years or later for $2000, but inflation has eroded some value of $1000 , then is it fair to tax you on $1000 in capital gains? I'd much rather be taxed on my income than be taxed less 13% and the pain of holding it for long term.

Elsewhere Obama is in favor of nearly doubling the capital-gains tax rate from 15 percent to 28 percent. How come not much debate on this point in the media? Because everyone is fat and lazy? Imagine what will happen to the market if Obama wins the election. He will give a window of time may be 3 months for the longs to realize their gains. Now if everyone start selling in that window of time... investors would flee from the market with any realized gains as fast as possible. What a disaster for the individual investor and for the market in general. New Mantra to become an instant millionaire –pray for Obama to win the election and be a long time short .Yes.. long time short:-)

Andrew, First of all, very nice job on what you have been predicting about GE for over 8 or 9 months is realistic(we could've bought puts though :(

Regarding this post, I am not quite sure I understand what you mean. Isnt four lows and four highs means bulls are ready :((

Unless we hit more bad news, next week full earnings from C MER etc. How do you think our ultrashorts would do?

Taxes will be going up next year. Count on it. And the easiest place to raise taxes is capital gains.

Can they change taxes and charge you retroactively? Meaning, can the next Congress/President change the tax rates in February 2009 and have it apply to any thing you did iin 2008?

SR,

I can see where I was confusing.

In counting th eup/down days, I was starting the clock after the big jump April 1st. Since then, the market didn't budge (up 3 points - what's that?). And then it crashed.

I think we are headed down hard because this is the start of the parade, and already the rain is out. Folks are going to run for cover. I'll share my thoughts in a blog post, but I think the Ultrashorts are going to look mighty tasty in 4 weeks (we should be closer to breakeven by then, if not ahead on those investments).

My guess is that shorts will do well next week till Fed comes up with some new balm to calm the market. Last week FII’s were seen selling in the Indian Market. Indication that Fed wants the money back? Sad...they have not gained anything in the Indian market.In the past 3-4 weeks every market gained atleast 10-15% but not Indian market. That confirms the belief that Indian Investors read this blog and they knew in advance the FII game plan ..hey ..hold on even Japan Govt read this blog :at least Toyota, they announced yesterday that they are going to invest heavily in a small car plant right in my hometown!!! ..sigh…market without prediction is lame and prediction without return is blind.

Post a Comment

Subscribe to Post Comments [Atom]

<< Home