Investing in the Oil Bubble

While oil is making all the headlines, the real action is coal and natural gas.

I will post a separate review of coal and NG later, although my previous posts include my target stocks for these sectors.

It's worth taking a big picture look at energy consumption. I will explore the myth of Peak Oil and show why today's oil prices are just an ordinary bubble, and then where to invest.

Energy consumption is growing overall but rocketing up in Asia.

Growth in global trade has led to massive increases in manufacturing, itself a major driver of energy consumption. In addition, getting richer means millions more people are joining the ranks of the middle class. Inevitably they aspire to the same living standards as enjoyed in the developed world : refrigerators, TVs, air conditioners, computers and so on. And of course, cars.

In the chart of global energy consumption, you'll see that the 5 year growth in energy demand is mild in the developed world (less than 5%). A lot of this growth comes from computers and the internet: according to the EPA, US data centers now consume 1.5% of total US energy consumption. Asia – the world's largest energy consumer - has seen energy consumption grow 38%. Big growth off a big base. The point being that developed world energy consumption has largely stabilized but that of Asia has a long way to go.

When it comes to electricity, multiple sources exist: coal, nuclear, wind, hydro, solar, natural gas and so on. When it comes to transportation, however, the only solution today is oil (forget ethanol for the moment).

Oil is a challenge for two reasons. First, there is no substitute (at least today). Second, global economies depend on hauling raw materials and finished goods.

INVESTMENT OPPORTUNITIES:

SHORT: Shippers (UPS, FEDEX), Truckers (pick any), planes (United or USairways), CCL

LONG: Railroads (CSX, KSU is my favorite), Boeing/PCP in 6 months (once Boeing begins shipping their fuel efficient planes), TIE, ZOLT (now that prices have fallen, expect more usage of lightweight, strong materials)

WHY OIL PRICES ARE SO HIGH: THE MYTH OF PEAK OIL

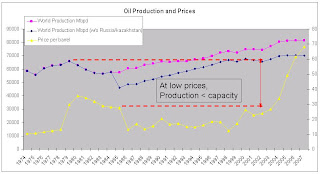

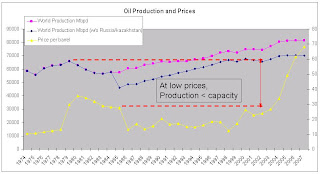

OPEC was formed 34 years ago with a mission: to manipulate prices by managing supply. They didn't do a very good job: oil stayed around $20~$30 for years. But the emergence of strong, new demand in Asia meant that the end of years of oversupply. One side effect of forcing production below capacity is that OPEC never invested in boosting capaccity - so now that they want to sell more oil at $135 a barrel, they can't!

Ever noticed that, every 20 years or so, when oil prices surge, we hear that oil won’t last more than 40 years. Then 20 years pass and, again, prices spike, and again we are told: oil won’t last more than 40 years. Sounds like the same crap peddled by real estate agents during the housing bubble: "prices ar ehigh and will stay high because they aren’t building land anymore."

It's hype to distract from massive specualtion.

Like diamonds, prices are high because a cartel has restricted supply. Unlike diamonds, it takes time to get new supply to the market.

KNOW YOUR HISTORY

Lets review the history of supply, demand, and price controls.

1974 OPEC is formed.

1979-81 prices surge due to Iranian revolution and impact on oil supplies

1982-1985 Prices begin falling. Saudi Arabia cuts production to stabilize oil prices, but it doesn't work – too much member cheating. By 1994, oil prices had fallen to the lowest level since OPEC was formed in 1973.

1995 A new cycle emerges. Demand surges from India and China. Supply also surges from former Soviet states.

1998 Prices soften further amid oversupply and slackening Asian demand (the Asian economic crisis). OPEC again tries to enforce production cuts in order to raise prices. On Jan 1st 1998, OPEC oil production stood at 27.5 million barrels per day, OPEC removes 4.2 Million bpd from production. It works: prices began to rise.

Note that at ~$25/barrel, there was minimal infrastructure investment to increase production AND there was plenty of spare capacity.

2000 OPEC reversed production cuts and added 3.7M bpd

2001 Chaos in the oil markets. A weakening US economy, 9/11, and more Russian supply all combine to undermine OPEC attempts to drive up prices. OPEC and Russia cut production a staggering 5.5M bpd. That is nearly 15% of combined supply taken off the market.

2002 Supply exceeded demand by 6M bpd.

2003 Oversupply stopped being a problem: falling to only 2M bpd.

* Surging demand from a strong global economy that now includes rapid India and China growth

* Shrinking supply Iraq (2M bpd), Venezuela (1M bpd), Mexico and Iran.

2007 OPEC has lost control. Price controls are no longer a matter of turning the faucet on or off. Lack of investment means that OPEC is operating almost at full capacity.

Venezuela and Iran followed similar paths in managing the oil revenue. Oil drives 65% of Iran’s government budget but they allocate only $4B per year to infrastructure improvements. Same with Venezuela. The result - they want to pump more but can not.

In 2007, oversupply was less than 1M bpd. That’s tight enough to where a slight disruption in supply matters. Israel fights Lebanon - oil prices spike. Nigerian oil pipeline disruptions - oil prices spike. But the real endemic problem is Russia: in May 2008 they reported that oil production slipped 0.7%.

Russia's problems are partly the Iran disease (underfunding oil infrastructure) and partly government intervention i nthe oil markets. In its rush to secure oil reserves and kick out the Western oil companies, Russia's oil development is slow.

The point is simple. Oil is alimited resource and we will run out of it. But today's oil price surge is not about a long term shortage. It is purely about supply mismanagement. And, arguably, demand mismanagement in the form of sloppy fuel standards for cars and planes.

OPEC wants high oil prices but not this high. They like $80 but not $135. The threat of permanently high oil prices is driving a lot of investment away from oil and into alternative energies. That’s a permanent and long-term threat to OPEC. Secondly, expensive oil is pushing weakening economies into a deeper slowdown, which always reduces demand. US fuel consumption has already started to decline. But, as usual, OPEC has overshot the mark in its efforts to manage prices and risks killing the golden goose.

Turning up more supply is an obvious step, and it will be taken. But another course of action is breaking the back of oil speculators who are taking advantage of short term supply disruptions.

The first step is a strong dollar. The Fed is all talk. But notice that, following the recent trip to the Middle East by Treasury Secretary Paulson, we see a firming of the dollar. Whereas Gulf countries were talking about moving away from the dollar, I bet they are now buying it. And we hear more discussion about making speculation technically harder and more expensive by raising the margin limits. Apparently, it is pretty cheap for Wall Street to trade oil commodities.

At the same time, expect China to raise the yuan. This will have a knock-on effect of raising global inflation somewhat (latest trade figures show that Chinese exports to the US are already seeing price inflation of 2.3%) A strong yuan reduces the value of Chinese dollar holdings, but it more critically reduces Chinese inflation from food and commodity imports. They subsidize oil, and a stronger Yuan will help.

INVESTMENT OPPORTUNITY:

DUG (oil short), get out of overseas stocks, buy dollars or sell the Yen. Buy Yuan.

On top of a slight OPEC oil supply increase, we will see slowing demand. One can play what-if games. What if US demand slows 1% (drops 210K bpd)? What if Global demand doesn’t grow 2M bpd but only 1M bpd.

It doesn't matter. Once there are signs that scarcity is not an immediate issue, expect speculators to leave and for prices to return to $100.

Prices could go even lower. Oil at $130 is a massive windfall – it is the only thing keeping Russian, Venezuela and Iranian governments in power. And they want to sell as much as they can. The pressure to pump more oil is going to drive demand for equipment and services to find and extract oil.

It will take years to hit serious oversupply. As long as oil is >$50, expect to see massive ongoing investment in oil extraction and production. Additionally, since 80% of world reserves are in the hands of State governments, public companies like Exxon will be looking offshore. Not in the Gulf of Mexico that is 200ft deep but 5 miles deep. So oil rigs and deep submersibles are a hot play for a while.

The bottlenecks in the supply chain are in drilling (wells, oil rigs), drilling equipment, and shipping. Secondly, there aren’t enough refineries. With extraction, distinguish between land based (aka known reserves) and offshore (aka unknown). Land based is about drilling new wells. Offshore is about oil rigs and exploration. And shipping in tankers

INVESTMENT OPPORTUNITY: MDR, FLR, ATW, DO, TTI, IO, NOV, FWLT, FLS, GNK, DSX

There are a few more I could throw out, but that's a good start.

I will post a separate review of coal and NG later, although my previous posts include my target stocks for these sectors.

It's worth taking a big picture look at energy consumption. I will explore the myth of Peak Oil and show why today's oil prices are just an ordinary bubble, and then where to invest.

Energy consumption is growing overall but rocketing up in Asia.

Growth in global trade has led to massive increases in manufacturing, itself a major driver of energy consumption. In addition, getting richer means millions more people are joining the ranks of the middle class. Inevitably they aspire to the same living standards as enjoyed in the developed world : refrigerators, TVs, air conditioners, computers and so on. And of course, cars.

In the chart of global energy consumption, you'll see that the 5 year growth in energy demand is mild in the developed world (less than 5%). A lot of this growth comes from computers and the internet: according to the EPA, US data centers now consume 1.5% of total US energy consumption. Asia – the world's largest energy consumer - has seen energy consumption grow 38%. Big growth off a big base. The point being that developed world energy consumption has largely stabilized but that of Asia has a long way to go.

When it comes to electricity, multiple sources exist: coal, nuclear, wind, hydro, solar, natural gas and so on. When it comes to transportation, however, the only solution today is oil (forget ethanol for the moment).

Oil is a challenge for two reasons. First, there is no substitute (at least today). Second, global economies depend on hauling raw materials and finished goods.

INVESTMENT OPPORTUNITIES:

SHORT: Shippers (UPS, FEDEX), Truckers (pick any), planes (United or USairways), CCL

LONG: Railroads (CSX, KSU is my favorite), Boeing/PCP in 6 months (once Boeing begins shipping their fuel efficient planes), TIE, ZOLT (now that prices have fallen, expect more usage of lightweight, strong materials)

WHY OIL PRICES ARE SO HIGH: THE MYTH OF PEAK OIL

OPEC was formed 34 years ago with a mission: to manipulate prices by managing supply. They didn't do a very good job: oil stayed around $20~$30 for years. But the emergence of strong, new demand in Asia meant that the end of years of oversupply. One side effect of forcing production below capacity is that OPEC never invested in boosting capaccity - so now that they want to sell more oil at $135 a barrel, they can't!

Ever noticed that, every 20 years or so, when oil prices surge, we hear that oil won’t last more than 40 years. Then 20 years pass and, again, prices spike, and again we are told: oil won’t last more than 40 years. Sounds like the same crap peddled by real estate agents during the housing bubble: "prices ar ehigh and will stay high because they aren’t building land anymore."

It's hype to distract from massive specualtion.

Like diamonds, prices are high because a cartel has restricted supply. Unlike diamonds, it takes time to get new supply to the market.

KNOW YOUR HISTORY

Lets review the history of supply, demand, and price controls.

1974 OPEC is formed.

1979-81 prices surge due to Iranian revolution and impact on oil supplies

1982-1985 Prices begin falling. Saudi Arabia cuts production to stabilize oil prices, but it doesn't work – too much member cheating. By 1994, oil prices had fallen to the lowest level since OPEC was formed in 1973.

1995 A new cycle emerges. Demand surges from India and China. Supply also surges from former Soviet states.

1998 Prices soften further amid oversupply and slackening Asian demand (the Asian economic crisis). OPEC again tries to enforce production cuts in order to raise prices. On Jan 1st 1998, OPEC oil production stood at 27.5 million barrels per day, OPEC removes 4.2 Million bpd from production. It works: prices began to rise.

Note that at ~$25/barrel, there was minimal infrastructure investment to increase production AND there was plenty of spare capacity.

2000 OPEC reversed production cuts and added 3.7M bpd

2001 Chaos in the oil markets. A weakening US economy, 9/11, and more Russian supply all combine to undermine OPEC attempts to drive up prices. OPEC and Russia cut production a staggering 5.5M bpd. That is nearly 15% of combined supply taken off the market.

2002 Supply exceeded demand by 6M bpd.

2003 Oversupply stopped being a problem: falling to only 2M bpd.

* Surging demand from a strong global economy that now includes rapid India and China growth

* Shrinking supply Iraq (2M bpd), Venezuela (1M bpd), Mexico and Iran.

2007 OPEC has lost control. Price controls are no longer a matter of turning the faucet on or off. Lack of investment means that OPEC is operating almost at full capacity.

Venezuela and Iran followed similar paths in managing the oil revenue. Oil drives 65% of Iran’s government budget but they allocate only $4B per year to infrastructure improvements. Same with Venezuela. The result - they want to pump more but can not.

In 2007, oversupply was less than 1M bpd. That’s tight enough to where a slight disruption in supply matters. Israel fights Lebanon - oil prices spike. Nigerian oil pipeline disruptions - oil prices spike. But the real endemic problem is Russia: in May 2008 they reported that oil production slipped 0.7%.

Russia's problems are partly the Iran disease (underfunding oil infrastructure) and partly government intervention i nthe oil markets. In its rush to secure oil reserves and kick out the Western oil companies, Russia's oil development is slow.

The point is simple. Oil is alimited resource and we will run out of it. But today's oil price surge is not about a long term shortage. It is purely about supply mismanagement. And, arguably, demand mismanagement in the form of sloppy fuel standards for cars and planes.

OPEC wants high oil prices but not this high. They like $80 but not $135. The threat of permanently high oil prices is driving a lot of investment away from oil and into alternative energies. That’s a permanent and long-term threat to OPEC. Secondly, expensive oil is pushing weakening economies into a deeper slowdown, which always reduces demand. US fuel consumption has already started to decline. But, as usual, OPEC has overshot the mark in its efforts to manage prices and risks killing the golden goose.

Turning up more supply is an obvious step, and it will be taken. But another course of action is breaking the back of oil speculators who are taking advantage of short term supply disruptions.

The first step is a strong dollar. The Fed is all talk. But notice that, following the recent trip to the Middle East by Treasury Secretary Paulson, we see a firming of the dollar. Whereas Gulf countries were talking about moving away from the dollar, I bet they are now buying it. And we hear more discussion about making speculation technically harder and more expensive by raising the margin limits. Apparently, it is pretty cheap for Wall Street to trade oil commodities.

At the same time, expect China to raise the yuan. This will have a knock-on effect of raising global inflation somewhat (latest trade figures show that Chinese exports to the US are already seeing price inflation of 2.3%) A strong yuan reduces the value of Chinese dollar holdings, but it more critically reduces Chinese inflation from food and commodity imports. They subsidize oil, and a stronger Yuan will help.

INVESTMENT OPPORTUNITY:

DUG (oil short), get out of overseas stocks, buy dollars or sell the Yen. Buy Yuan.

On top of a slight OPEC oil supply increase, we will see slowing demand. One can play what-if games. What if US demand slows 1% (drops 210K bpd)? What if Global demand doesn’t grow 2M bpd but only 1M bpd.

It doesn't matter. Once there are signs that scarcity is not an immediate issue, expect speculators to leave and for prices to return to $100.

Prices could go even lower. Oil at $130 is a massive windfall – it is the only thing keeping Russian, Venezuela and Iranian governments in power. And they want to sell as much as they can. The pressure to pump more oil is going to drive demand for equipment and services to find and extract oil.

It will take years to hit serious oversupply. As long as oil is >$50, expect to see massive ongoing investment in oil extraction and production. Additionally, since 80% of world reserves are in the hands of State governments, public companies like Exxon will be looking offshore. Not in the Gulf of Mexico that is 200ft deep but 5 miles deep. So oil rigs and deep submersibles are a hot play for a while.

The bottlenecks in the supply chain are in drilling (wells, oil rigs), drilling equipment, and shipping. Secondly, there aren’t enough refineries. With extraction, distinguish between land based (aka known reserves) and offshore (aka unknown). Land based is about drilling new wells. Offshore is about oil rigs and exploration. And shipping in tankers

INVESTMENT OPPORTUNITY: MDR, FLR, ATW, DO, TTI, IO, NOV, FWLT, FLS, GNK, DSX

There are a few more I could throw out, but that's a good start.

3 Comments:

Hi Andrew,

How does the DUG work ?

is it used for shorting the oil ?

When buy the call option DUG, does it mean shorting the oil ? The lower the oil price is, the higher the call option premium is, is that correct ?

thanks

your faithful follower.

Andrew,

Then what is the difference to buy a put option of USO vs buy a call option of DUG ?

thanks

DUG is an ETF that goes up when oil prices go down. USO is the opposite - an ETF that goes up with oil prices. These ETFs tend to be somewhat turbocharged: they move 2:1 versus the stock movements.

This is not an option - so no expiration.

DUG is not a perfect anti-oil play: although most of the holdings are pure oil plays (i.e. Exxon) about 15% of the holdings are service and infrastructure plays. I like service and infrastructure: as long as oil remains >$50 a barrel, demand will be there to drill and extract oil. And they are still relatively low P/E.

The advantage of buying DUG and not buying USO puts is that the puts expire whereas the DUG position does not.

There is clear government coordination to bring down the price of oil. It will succeed in the short term, which is why this is a short term play (1 month). I would expect oil to drift a little higher as markets test Saudi ability to raise supply. But oil is heading down to <$120 by the end of the Summer imho.

Post a Comment

Subscribe to Post Comments [Atom]

<< Home