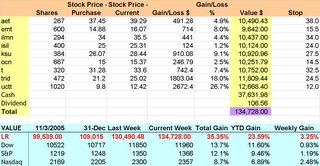

LiveRocket Week 47 Results: Up 3.25%

A solid week thanks especially to UCTT & TRID.

I am not convinced that this isn’t a sucker’s rally. As such, I am keeping very tight STOPs and not reinvesting the ~$38K in cash for now.

My reasoning is as follows:

1. No earnings blowouts: stocks surge when they beat earnings, not when they come close.

2. Economy is slowing down

3. It’s October: a traditionally bad investing month.

4. Lot of short covering.

Notice that I did not mention consumer spending. I think consumer spending is still pretty solid and will stay that way until January’s hangover. Here’s why:

Studies have shown that people spend more when their home value increases than when the stocks go up. By the end of December, I think drops in housing prices will be much more publicly known. People will feel poorer. And then the ARMs get reset, and tens of thousands of homeowners will be forced to either sell at a loss or eat peanut butter and jelly sandwiches for a long time.

Oh, and then there’s the employment issue. 500,000 construction workers will be laid off over the next year (with housing building dropping 50%, that is inevitable). The loss of spending will ripple through the economy. The Fed estimates that the cumulative impact will cut 1% off the economy.

Eternal optimists think that people will spend their newfound gas savings from the drop in gas prices. As if a family will rush out and blow that $100 on a new washing machine.

INFLATION WATCH

The Fed is lucky in that inflation will drop. The prices of homebuilding related commodities is dropping, and dropping fast. Lumber, copper, and steel will be dropping, and gas has dropped 15% from its high.

The important thing to note is that this slowdown is demand driven, whereas much of the price growth came from supply constraints. If demand is truly slowing, we will be hitting a vein of major oversupply as companies continue to push more capacity.

Inflation will ease as the raw materials costs moderate. It may even be good for corporate earnings (especially if companies can’t raise prices in the face of slowing demand).

This means that the Fed strategy is succeeding. But 5 of the Fed Governors have said in recent days that they still see inflationary problems. That means no letting up on the interest rate. Meanwhile, housing deflation is picking up. This will be the 2007 economic variable to watch. The best thing for the economy would be a drop in housing prices of at least 40%. Ultimately, that drop or deeper is exactly where we will end up, but a slow train wreck is the worst because it draws out the financial pain and misallocation of resources.

The Fed will begin to drop rates within 4 months to keep the economy perky. It will be interesting to see how the housing prices respond.

AET: Staying a tight 3% trading range. I’m looking for a post earnings bump. I also like the recent layoff of 2% of staff. I am looking for them to get back to the $52 level before I sell. The technicals (MACD) are looking very positive as well.

EMT: I almost hit the button on Monday but I held off. They have broken through the $16 resistance set by Telmex’s offer to buyout. Good technicals as well.

ILMN: No news. They have established a nice trading point around $35, but the low points are higher.

ISIL: I am seeing some wind under ISIL. Basically, this was a play to buy a growing semiconductor company and to get some reflected premium off my perception that semis would come back into favor. Still waiting.

KSU: Up a solid 8% in 2 weeks. This is a long term investment where the payoff is probably more in the future. Strong technicals.

OCN: I don’t understand why this stock isn’t surging yet. With foreclosures across the country surging (tripled in California since last year), that is money in the pocket for OCN. Probably needs a solid quarter’s earnings to get another bump. Technicals have also turned neutral.

T: One more step closer to a Bellsouth merger. I like the Citigroup upgrade to Buy from hold (after already moving up 20%)

TRID: Really solid technicals. TRID could be hitting $30 soon, especially if they resolve the options issue. And this is before the quarterly release. And a new high for the last 5 months.

UCTT: Wow. A new 52 week high. Someobody must know something.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home