Sell into the fake rally

* Lowe's profits - down

* Home Depot profits - down

* CBS profits - down

* Nordstrom's profits - down

* Foreclosures soar 57%

* Oil is $100

* Inflation excluding oil/food is at 4.3%

* Housing sales continue to drop (albeit 'only' 0.4% last month)

But the market is up. In fact, volumes are strengthening.

In August, the market plunged 6% before recovering

In November, the market plunged 7% before recovering

In January, the market plunged 12% before partially recovering

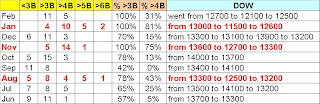

During these selloff months, 4B+ days become the rule: 43% of all trading days in August were 4B shares or greater, 75% in November and a whopping 81% in January.

In essence, money creeps in but it runs away.

What about February? Only high volume trading days. Sounds like we are still in sell-off country.

This is a fake rally - don't buy it. Excitement comes from things not being awful at insurers MBIA and Ambac. The patient has no limbs, but isn't entirely dead. Yet. Perhaps the bad news is out and we can recover.

There are at least 2 reasons why things will get dramatically worse: the 2nd phase of mortgage re-sets and oil

Recall the wonderful Credit Suisse ARM calendar for re-sets

Month 16 is March, 2008, when we see the next big wave of re-sets.

Month 16 is March, 2008, when we see the next big wave of re-sets.

We are just seeing the results of the first wave. The 7 month lag between re-set and foreclosure activity is partly due to the process itself and partly due to lenders' unpreparedness. They didn't have the staff or mindset to deal. And many were more focused on staying alive.

For the 2nd wave, however, lenders will move faster. Already they are raising the risk premiums for mortgages. While the Feds have cut interest rates from 5.25% to 3%, the market has decided to raise the cost of borrowing, ignoring 2.25% in rate cuts.

In essence, the market knows that there is no government handout or rescue. The Bush plans and other solutions are meaningless. As I warned before, the risk premium has returned with a vengeance. And if the cost of borrowing is bad for the homeowner, it is getting bad for the consumer and for businesses.

So another refinancing bubble has fizzled out. And with it, the last hope of overstretched homeowners. On top of that, we have the second half of the first re-set wave.

That means more homes on the market and tighter lending. The consumer economy is getting choked.

Meanwhile, we have oil. The average person drives 1000 a month, or about 50 gallons of gas. So $40 a month or so of extra costs. In and of itself, no problem.

But for business, this is calamitous.

SHIPPING COSTS We operate today based on a just-in-time economy where products are shipped overnight or from long distances. Think Fedex planes and trucks. Oil hits them right where it counts. Now every product has to raise prices to reflect shipping costs. (Makes KSU look very attractive - they can ship via railroad from the West Coast to Kansas.)

MANUFACTURING COSTS Whether made here or in China, plastics cost more money. And so does the energy required to make things.

We would have seen this inflationary impact sooner, except that companies absorbed the costs. At a time of falling margins, they can no longer do so. They have begun passing the costs along and that's why inflation is so high.

I expect some workarounds to emerge. More leveraging of railroads (so a 5 day package becomes 7 days). But this is how we get stagflation - inflation runs higher and the economy is slowing.

That is the real economic background and why you should be selling into this rally. The housing debacle hsa eclipsed this bigger reality. In 1 or 2 quarters, the truth will be obvious an dthe market will crash really hard.

* Home Depot profits - down

* CBS profits - down

* Nordstrom's profits - down

* Foreclosures soar 57%

* Oil is $100

* Inflation excluding oil/food is at 4.3%

* Housing sales continue to drop (albeit 'only' 0.4% last month)

But the market is up. In fact, volumes are strengthening.

In August, the market plunged 6% before recovering

In November, the market plunged 7% before recovering

In January, the market plunged 12% before partially recovering

During these selloff months, 4B+ days become the rule: 43% of all trading days in August were 4B shares or greater, 75% in November and a whopping 81% in January.

In essence, money creeps in but it runs away.

What about February? Only high volume trading days. Sounds like we are still in sell-off country.

This is a fake rally - don't buy it. Excitement comes from things not being awful at insurers MBIA and Ambac. The patient has no limbs, but isn't entirely dead. Yet. Perhaps the bad news is out and we can recover.

There are at least 2 reasons why things will get dramatically worse: the 2nd phase of mortgage re-sets and oil

Recall the wonderful Credit Suisse ARM calendar for re-sets

Month 16 is March, 2008, when we see the next big wave of re-sets.

Month 16 is March, 2008, when we see the next big wave of re-sets.We are just seeing the results of the first wave. The 7 month lag between re-set and foreclosure activity is partly due to the process itself and partly due to lenders' unpreparedness. They didn't have the staff or mindset to deal. And many were more focused on staying alive.

For the 2nd wave, however, lenders will move faster. Already they are raising the risk premiums for mortgages. While the Feds have cut interest rates from 5.25% to 3%, the market has decided to raise the cost of borrowing, ignoring 2.25% in rate cuts.

In essence, the market knows that there is no government handout or rescue. The Bush plans and other solutions are meaningless. As I warned before, the risk premium has returned with a vengeance. And if the cost of borrowing is bad for the homeowner, it is getting bad for the consumer and for businesses.

So another refinancing bubble has fizzled out. And with it, the last hope of overstretched homeowners. On top of that, we have the second half of the first re-set wave.

That means more homes on the market and tighter lending. The consumer economy is getting choked.

Meanwhile, we have oil. The average person drives 1000 a month, or about 50 gallons of gas. So $40 a month or so of extra costs. In and of itself, no problem.

But for business, this is calamitous.

SHIPPING COSTS We operate today based on a just-in-time economy where products are shipped overnight or from long distances. Think Fedex planes and trucks. Oil hits them right where it counts. Now every product has to raise prices to reflect shipping costs. (Makes KSU look very attractive - they can ship via railroad from the West Coast to Kansas.)

MANUFACTURING COSTS Whether made here or in China, plastics cost more money. And so does the energy required to make things.

We would have seen this inflationary impact sooner, except that companies absorbed the costs. At a time of falling margins, they can no longer do so. They have begun passing the costs along and that's why inflation is so high.

I expect some workarounds to emerge. More leveraging of railroads (so a 5 day package becomes 7 days). But this is how we get stagflation - inflation runs higher and the economy is slowing.

That is the real economic background and why you should be selling into this rally. The housing debacle hsa eclipsed this bigger reality. In 1 or 2 quarters, the truth will be obvious an dthe market will crash really hard.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home