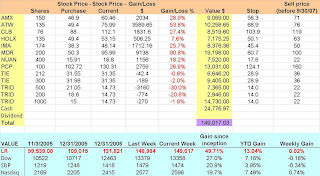

LiveRocket Week 35 Performance - Flat

We were stopped out of CTSH, ESV, PWR and UCTT. I regret PWR the most. Nevertheless, we now have $25K to buy some hot stocks, and that's where we are going. I am not going to pile back in. We already have plenty of money in 2 stocks that do not show market enthusiasm (TRID, TIE) and that's plenty for now.

My strategy is to remain recession-proof multinational, continue the focus on oil services and equipment companies, and concentrate more on infrastructure among emerging and developing economies.

Recession proof Multinational: HOLX, IMA

Oil services/equipment: ATW, CLB, MDR

Infrastructure: AMX, PCP, TIE

Other: NUAN, TRID

The picks I have in mind fit these areas:

INFRASTRUCTURE:

MICC - Emulates AMX as a cell phone company except that it is much smaller: $8B vs $100B for AMX. The smaller size in the explosive cell phone sector makes it have better revenue growth as well: 76% vs 30%. It also has a much lower P/E and P/S.

AMX territory: Mexico, Brazil, Chile, Peru, Argentina, Paraguay, Uruguay, Colombia, and

Ecuador.

MICC territory: El Salvador, Guatemala, and Honduras in Central America; in Bolivia, Colombia, and Paraguay in South America; in Chad, the Democratic Republic of Congo, Ghana, Mauritius, Senegal, Sierra Leone, and Tanzania in Africa; and in Cambodia, Laos, and Sri Lanka in Asia

If AMX continues its aggressive buyout campaign, MICC is in its sights.

ZNH - I don't trust Chinese accounting. I am willing to go after this company for a few reasons

1. Chinese domestic air travel can only grow

2. ZNH has a dominant position - largest Chinese airplane company by fleet size.

3. Stronger yuan will reduce fuel costs

4. THE OLYMPICS - People will fly in and want to travel.

5. Foreign airlines interest - Look for links to be established via chare purchases by other companies. Creates underlying price support.

And then there is the recent announced purchase of 55 Boeings. I look at that as a response to burgeoning growth.

Downsides are the Chinese economy slowing down (I don't see that happening anytime soon) and overvaluation. The latter makes me hesitate somewhat. Very few shares are floated (629K sahes) and 350K are shorted. This price bump may really be tied to a short squeeze.

for that reason, I will put ZNH back on a watch list for now.

OIL SERVICES/EQUIPMENT

NOV - I would call these guys "Pipeline and extraction buildout." A more focused version of MDR. In fact, they are growing faster and have better margins than MDR.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home